A Comparative Market Analysis (CMA) adjustment guide is essential for accurately valuing properties by considering factors like size, age, and market trends in 2023.

Understanding the Importance of CMA Adjustments in 2023

CMA adjustments are crucial for accurate property valuations in 2023, ensuring fair market prices by accounting for factors like size, age, and location. They help agents and appraisers align property values with current market conditions, making listings more competitive. Adjustments also enable precise comparisons between properties, highlighting differences in amenities and condition; By incorporating recent sales data and market trends, CMA adjustments provide a defensible and reliable valuation process. This approach supports informed decision-making for buyers, sellers, and investors, ensuring transparency and fairness in real estate transactions. Accurate adjustments are vital for maintaining credibility in the market.

Defining the Subject Property

Defining the subject property involves identifying its key characteristics such as location, size, age, and condition to ensure accurate comparisons with similar properties.

Key Characteristics to Consider for Accurate Valuation

When defining the subject property, consider its location, size, age, and condition. Location affects accessibility and amenities, while size and age influence value. Condition impacts maintenance costs and appeal, ensuring accurate comparisons with similar properties for reliable valuations in 2023.

Setting Criteria for Comparable Properties

Define clear criteria for comparable properties, focusing on location, size, age, and condition to ensure accurate valuations. Properties should be within the same area and similar characteristics.

Location, Size, Age, and Condition Factors

Location significantly impacts value, with proximity to amenities and services being critical. Size differences require adjustments, such as $50 per square foot. Age affects maintenance costs, with older homes potentially needing up to 10% adjustments. Condition variations, like renovations or disrepair, can justify adjustments ranging from 5% to 20%. These factors ensure accurate valuations by reflecting market dynamics and property-specific traits.

Gathering Data on Recent Sales

Collecting reliable market data on recent sales is crucial for accurate valuations. Use MLS, public records, or online platforms to gather info on comparable properties sold in 2023.

How to Collect Reliable Market Data for CMA

To gather reliable market data for a CMA, focus on recent sales within the same or nearby areas. Use MLS systems, public records, or platforms like Zillow to access accurate info. Ensure the data reflects current market conditions by filtering sales within the past 6-12 months. Prioritize properties with similar characteristics to the subject property, such as size, age, and condition. Verify the accuracy of the data by cross-referencing multiple sources. Include details like sale dates, property features, and sold prices to create a comprehensive dataset for adjustments.

Analyzing Active, Pending, and Expired Listings

Active listings indicate current market demand, while pending and expired listings reveal negotiation trends and pricing strategies, aiding in precise CMA adjustments in 2023.

Understanding Market Dynamics Through Listing Analysis

Analyzing active, pending, and expired listings provides insights into market trends, buyer behavior, and pricing strategies. Active listings reveal current demand and competition, while pending sales indicate buyer activity and negotiation strength. Expired listings highlight overpricing or unfavorable conditions. By studying these dynamics, real estate professionals can identify patterns, such as average days on market and price adjustments, to refine CMA adjustments. This analysis also helps in understanding shifts in buyer preferences and market saturation, enabling more accurate property valuations and informed decision-making in 2023.

Adjustments Based on Square Footage

Square footage adjustments are calculated using the average price per square foot of comparable properties. A common rule applies 1/3 of this average to determine adjustments, ensuring fair valuation based on size differences in 2023.

Calculating Adjustments Using Average Price per Square Foot

Adjustments based on square footage are determined by calculating the average price per square foot of comparable properties. A common rule applies 1/3 of this average to determine adjustments. For instance, if comparable homes sell at $150 per square foot, the adjustment would be $50 per square foot. This method ensures fair valuation by accounting for size differences. It’s widely used in CMA adjustments to maintain accuracy and consistency in appraisals, reflecting market trends and property characteristics effectively in 2023.

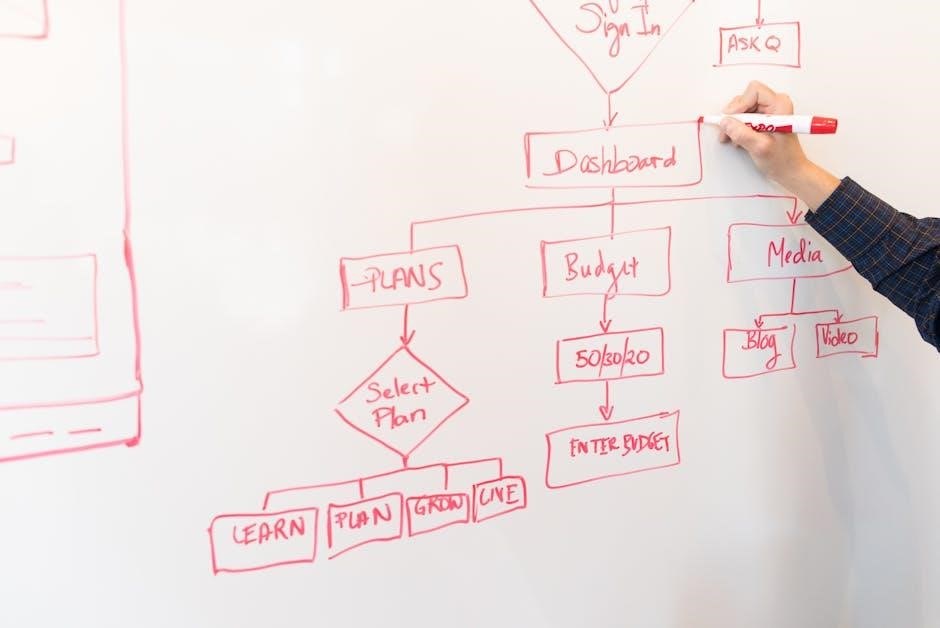

Using the Comparable Sales Adjustment Grid

The Comparable Sales Adjustment Grid systematically organizes data for precise value comparisons, ensuring transparency and defensibility in valuations by standardizing adjustments across key property characteristics in 2023.

A Tool for Systematic Value Review and Defense

The Comparable Sales Adjustment Grid is a structured tool that simplifies the valuation process by organizing data from comparable properties. It enables appraisers and agents to systematically review and defend property values by applying consistent adjustments for factors like size, age, and condition. This grid ensures transparency and accuracy in valuations, making it easier to justify adjustments during reviews or disputes. By standardizing the adjustment process, it enhances the credibility of the CMA report, providing a clear and defensible basis for property value determinations in 2023.

Neighborhood and Location Factors

Proximity to amenities, schools, and transportation significantly influences property value. Neighborhood characteristics like safety, zoning, and environmental factors also play a role in CMA adjustments.

How Proximity to Amenities and Services Impacts Value

Proximity to amenities like schools, parks, shopping centers, and public transportation significantly enhances property value. Properties near these services are often more desirable, commanding higher prices. Conversely, locations far from amenities or in less accessible areas may require downward adjustments. Additionally, access to healthcare facilities, restaurants, and recreational spaces can further influence value. In 2023, market trends emphasize the importance of convenience, with buyers willing to pay premiums for properties in well-served neighborhoods. This factor is crucial in CMA adjustments, reflecting broader market preferences and lifestyle demands.

Age and Condition Adjustments

Age and condition significantly impact property value, with newer, well-maintained homes often requiring upward adjustments, while older or deteriorated properties may need downward adjustments in 2023.

Accounting for Property Age and Maintenance in CMA

Property age and maintenance significantly influence value. Newer homes may warrant upward adjustments due to modern features, while older properties could require downward adjustments for potential repairs or outdated systems. Regular maintenance can justify higher valuations, whereas neglect may reduce value. Adjustments vary by market and condition, ensuring fair valuations.

Incorporating Market Conditions and Trends

Market conditions, such as rising or falling trends, significantly impact property values. Adjustments must reflect current trends to ensure accurate and defensible valuations in 2023.

Adjusting for Rising or Falling Market Trends

Market trends significantly influence property values, requiring precise adjustments in CMA reports. Rising trends may justify higher valuations, while falling trends necessitate downward adjustments. Appraisers must analyze current market dynamics, such as supply and demand shifts, to determine appropriate adjustments. Fannie Mae guidelines emphasize the importance of documenting trend-based adjustments to ensure compliance and transparency. Adjustments should reflect accurate data, considering factors like location and property type. This ensures valuations remain defensible and aligned with market conditions in 2023.

Fannie Mae Guidelines for Market Condition Adjustments

Fannie Mae’s 2023 guidelines standardize market condition adjustments, ensuring appraisers use reliable data and document trends accurately for compliant valuations.

Compliance with Appraisal Standards in 2023

Compliance with appraisal standards in 2023 requires adherence to Fannie Mae guidelines, ensuring adjustments are defensible and accurately reflect market conditions. Appraisers must document trends and support adjustments with reliable data, aligning with USPAP standards to maintain valuation integrity and credibility in the market analysis process.

Step-by-Step Guide to Adjusting Comparables

Define the subject property, select comparables, gather recent sales data, and adjust for differences like size, age, and condition using reliable market data systematically.

Practical Approach to Making Accurate Adjustments

A practical approach involves systematically evaluating each comparable property, starting with defining the subject property and setting clear criteria for comparables. Collecting recent sales data is crucial, ensuring the information is reliable and relevant. Analyze active, pending, and expired listings to understand market dynamics better. Adjustments should be made based on factors like square footage, using the average price per square foot as a guide. Utilize tools like the Comparable Sales Adjustment Grid to review and defend value systematically. This method ensures defensible and accurate valuations by considering location, size, age, and condition of properties. Regular updates and adherence to Fannie Mae guidelines in 2023 are essential for compliance and reliability in the market analysis process. By following these steps, adjustments become precise and justified, leading to trustworthy valuations that reflect current market conditions accurately.

Best Practices for Accurate CMA Adjustments

Adhere to market guidelines, use reliable data, and systematically evaluate comparables. Ensure transparency in adjustments and maintain consistency in valuation methods for defensible results in 2023.

Ensuring Defensible and Reliable Valuations

Defensible valuations require thorough documentation of adjustments, ensuring each adjustment is supported by market data. Regularly review and update comparables to reflect current market conditions. Utilize standardized methods and tools, such as the Comparable Sales Adjustment Grid, to maintain consistency. Transparency in the adjustment process is crucial, allowing stakeholders to understand the rationale behind valuation decisions. By adhering to these practices, appraisers can produce reliable and defensible valuations that stand up to scrutiny in 2023.